Structural growth drivers with margin expansion

Global regulated gambling markets, led by the Americas, are expected to grow materially. Playtech is well-positioned to participate given its broad, high-quality product offering and attractive asset portfolio, which benefits from the attractive blend of mature, cash generative assets and investments into fast growing newly regulated markets. High operating leverage and a focus on operational efficiency prime Playtech to deliver margin expansion and increased free cash flow generation.

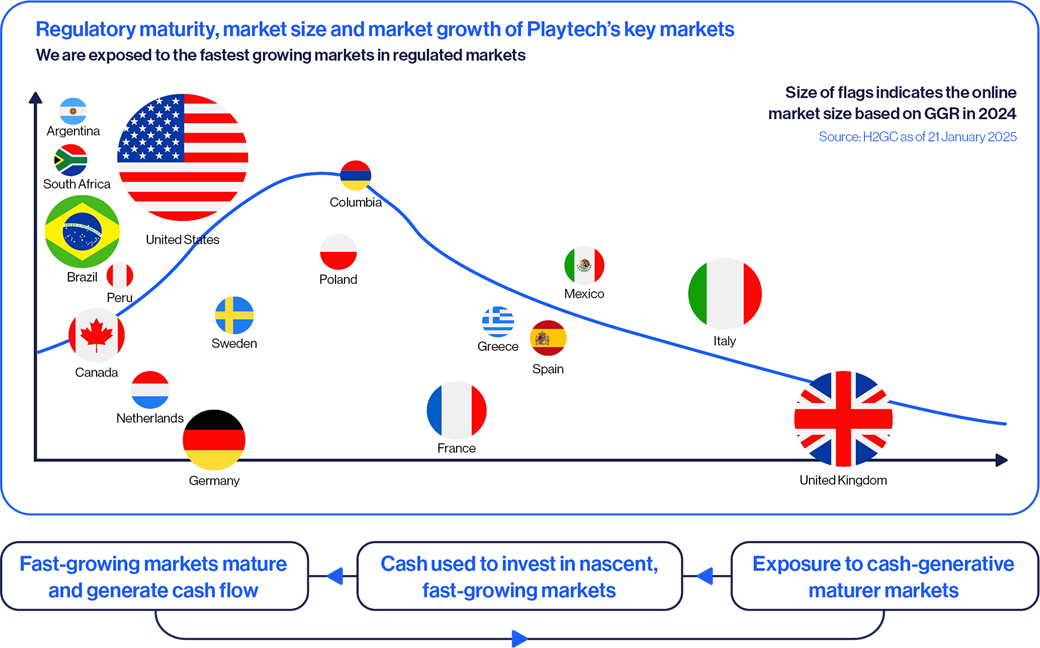

An attractive blend of mature, cash generative markets and the fastest growing newly regulated markets

The gambling market is in the midst of a supercycle, driven by the expansion of regulated and regulating markets, with the Americas leading the way. Playtech is well placed to capture this considerable opportunity with its B2B business model.

There is also a healthy balance between more mature markets such as the UK and Italy, and countries that are early in their regulatory cycle, and thus set to deliver faster growth. Cash from these more mature markets can be used to invest into more nascent, faster growing markets to secure advantageous positions as these markets move towards regulating.

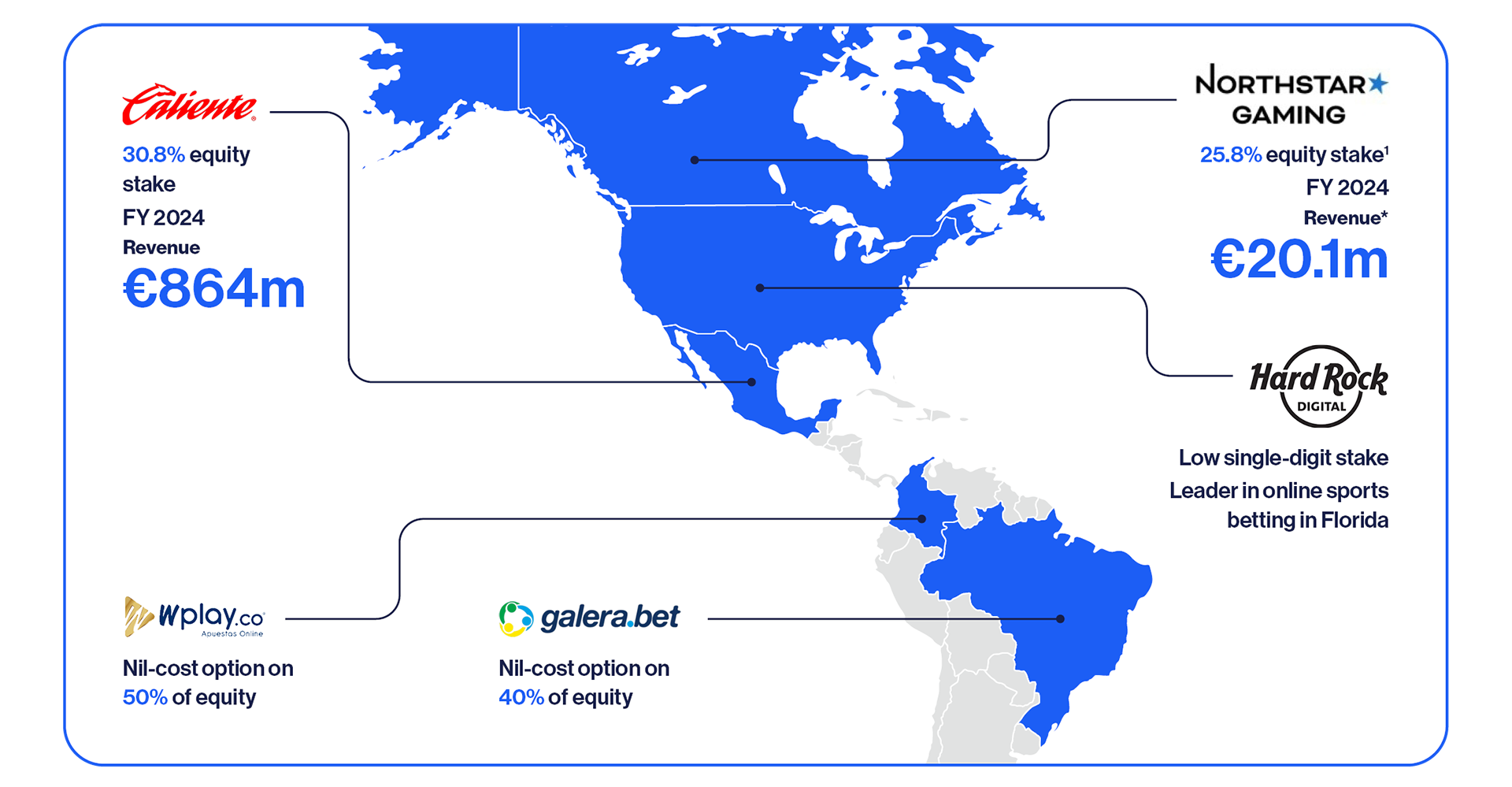

B2B portfolio comprises high-quality assets strategically positioned to drive growth

1If the convertible debenture were to be converted into common shares and all of Playtech's warrants were to be exercised, the Group could potentially further increase its stake beyond 40%.

*NorthStar Gaming revenue calculated using actual results for Q1 to Q3 revenue and preliminary results for Q4 revenue; Revenue is converted from CAD to EUR using the average FX rate.

In the Americas and aside from our commercial relationships with over 200 operators in regulated markets, we have multiple equity stakes in high-quality assets in attractive countries. The 30.8% equity stake that we hold under the revised Caliplay agreement is valuable in our view, given its revenue and earnings growth and dominant position in a rapidly growing Mexican market.

Our other structured agreements are at a much earlier stage than Caliplay, yet some of these agreements have huge potential to generate value for Playtech’s shareholders, including our nil-cost option on 40% of the equity in Brazilian operator, Galerabet. In the US, our low single-digit equity stake in Hard Rock Digital gives us valuable exposure to the growing business, which in our opinion possesses all the necessary characteristics to become, over time, a significant contributor to Playtech.

Good operating leverage, supplemented by increased focus on cost efficiencies to drive margin expansion

Within the Live Casino business, Playtech has already made significant investments in studio infrastructure. Within SaaS, Playtech has also invested heavily in data centres to be able to serve its customer base, while it has already signed up hundreds of brands with scope to increase wallet share. Investment to date lays the groundwork for higher operating leverage going forward. In addition, there will be increased focus on operational efficiencies to ensure the cost base is aligned with the remaining B2B business. As a result, we expect Playtech to be able to deliver margin expansion in the years ahead, which, combined with accelerating top-line growth, will help to deliver earnings growth.